Many business leaders are increasingly feeling the pressure to fight fraud on a number of fronts. I think about these as being in two broad categories, namely internal fraud and external fraud.

In my mind, fraud can take place either physically or through the use of technology.

Thus, my advice to start reducing the risk of fraud falls into two camps: human and technological.

In this first blog, I will be talking about fighting fraud on the human front. Please come back to read the second blog on basic technology that can be used to fight fraud.

But remember, this blog just gives you a starting point, and if you hold particularly sensitive data and are subject to various regulations, then you need to get professional advice tailored to your particular circumstances. There is not a “one size fits all” when it comes to business fraud.

Fighting Fraud on the Human Front

At the heart of it, all fraud is human – it’s just a choice of whether to use people or technology as the tool. In many cases, it is easier and cheaper to use people. It is within the skill set of all fraudsters – rather than just a technical few.

1. Know the background of your people

Of course, if you don’t ever check identities of your team when you recruit them, you won’t know if they have a previous history of fraud, whether they have the right to work in the country, and so on.

2. Reduce ‘fraud through ignorance’

Often internal employees end up complicit in a fraud, because they haven’t been given the necessary training to recognize fraud and deal with the consequences. So start with training – how can your employees recognize fraud and what should they do if they suspect fraud.

3. Get your policies and processes in place

It’s no good doing the training if you don’t have the policies and processes for that training to link back to. It must be clear to employees what is expected and that they are protected in the process – otherwise no one will be willing to whistle-blow.

4. Segregate activities

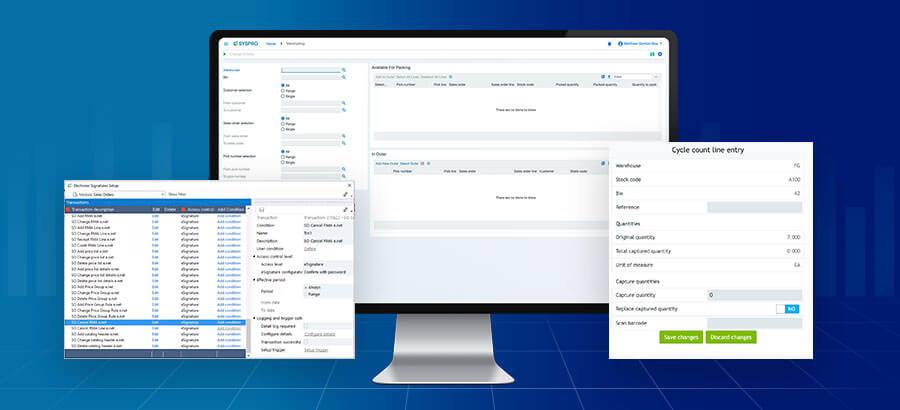

You don’t have to go the whole hog of Sarbanes Oxley if it’s not appropriate, but do separate key activities. SYSPRO ‘s e-Signatures and Workflow modules can help manage this in your business – so you get the benefits of segregation, without a huge processing cost overhead.

5. Use your data

Identify patterns in employee and customer behavior vs. returns, supplier prices, inventory levels etc., in order to root out potential sources of fraud.

Only by getting the people side of the equation in check, can you go on to reliably implement technical solutions, and what’s more tackling the human side can generate impressive results with very little effort.